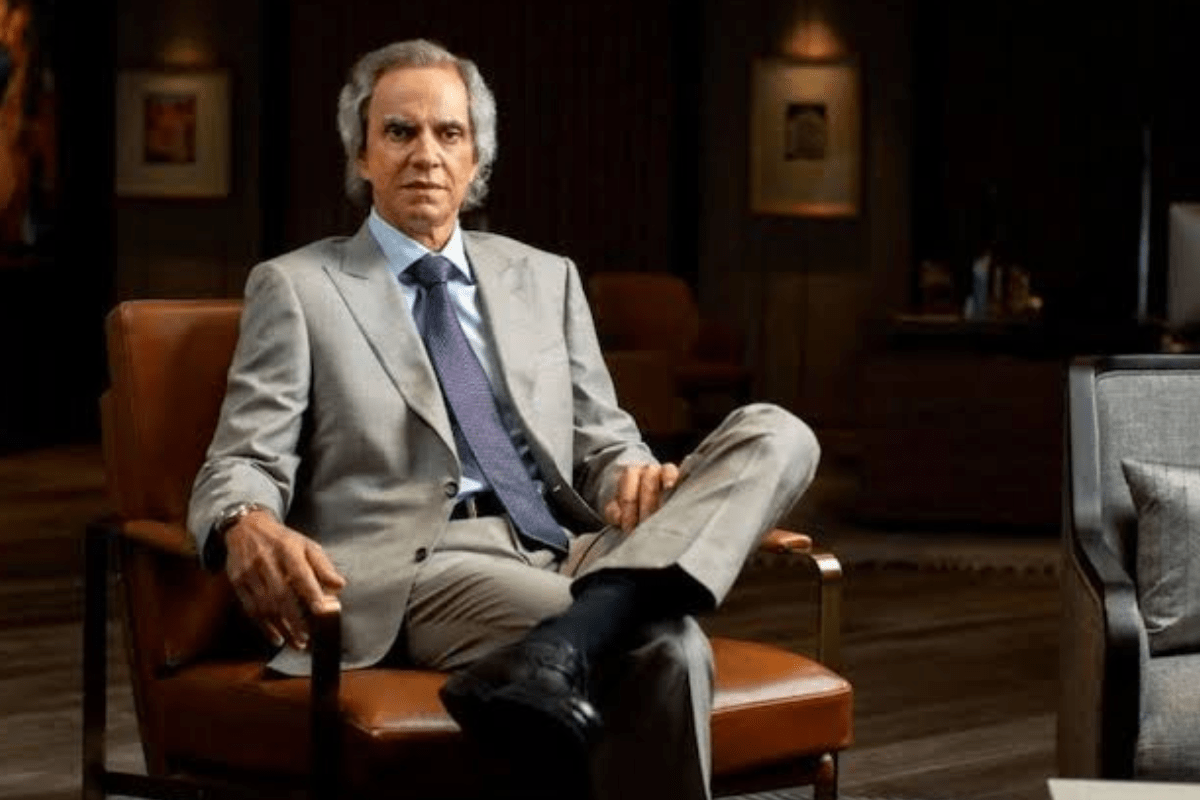

Billionaire Enrique Razon Jr., a prominent figure in the Philippines’ business landscape with ventures spanning casinos to ports, is significantly expanding his investment in Manila Water. In a strategic move to consolidate his influence in the water utility sector, Razon has acquired an additional 14.5 billion pesos ($252 million) worth of shares in Manila Water from Ayala Corp. This acquisition highlights Razon’s commitment to strengthening his foothold in critical infrastructure industries within the country.

A Strategic Acquisition through Trident Water

The acquisition was executed through Razon’s privately held investment vehicle, Trident Water. This deal entails the purchase of a 23.6% stake in Manila Water’s common shares for 12.9 billion pesos. Additionally, Trident Water will acquire 1.6 billion pesos of Manila Water preference shares from Ayala’s Philwater over the next five years. Upon completion, Trident Water will hold approximately 82% of Manila Water’s common shares, significantly increasing Razon’s control over the company.

Manila Water, under Razon’s leadership, continues to provide reliable and efficient water and wastewater services to key metropolitan areas in the Philippines and abroad. In a statement, Razon, who is also the chairman of Manila Water, emphasized the company’s ongoing efforts to optimize operations and expand both domestically and internationally.

Ayala Corp’s Divestment Strategy

This transaction marks a pivotal moment for Ayala Corp, one of the Philippines’ oldest and most diverse conglomerates with interests in banking, property, and telecommunications. Ayala Corp has been systematically divesting its stake in Manila Water as part of a broader strategy to rationalize its portfolio and raise capital. Following this sale, Ayala will no longer hold common shares in Manila Water, and its 12% economic stake through preferred shares will be phased out by 2029, following full payment by Trident Water.

Ayala Corp stated that these transactions align with its strategic objective to streamline its investment portfolio and generate substantial proceeds. The total proceeds raised from Ayala’s portfolio rationalization initiatives will amount to approximately 51.5 billion pesos, surpassing their initial target of 50 billion pesos.

Razon’s Growing Infrastructure Portfolio

Enrique Razon’s decision to deepen his investment in Manila Water is a testament to his broader strategy of expanding his infrastructure portfolio. Razon, who derives a significant portion of his wealth from International Container Terminal Services Inc (ICTSI) and Bloomberry Resorts Corp, has been increasingly focusing on critical infrastructure projects.

Through his privately held Prime Capital Infrastructure, Razon is spearheading the development of a dam project that is expected to boost Manila Water’s capacity by 30%. Additionally, he is involved in developing new deepwater wells in the Malampaya gas fields located in the West Philippine Sea. These initiatives are part of Razon’s vision to enhance the Philippines’ infrastructure and water supply capabilities, ensuring sustainable growth and development.

Impact on Manila Water and Future Prospects

The increased investment by Razon is expected to bring about significant improvements in Manila Water’s operational efficiency and service delivery. With Razon at the helm, the company is poised to leverage his extensive experience in managing large-scale infrastructure projects. This strategic infusion of capital and expertise is anticipated to drive Manila Water’s growth both within the Philippines and in international markets.

Manila Water serves over seven million residents in Metro Manila’s eastern region, and its expansion plans under Razon’s leadership include enhancing water distribution networks, upgrading wastewater treatment facilities, and exploring new markets. The company’s commitment to sustainability and innovation positions it well to address the growing demand for reliable water services amid increasing urbanization and environmental challenges.

Conclusion

Enrique Razon Jr.’s substantial investment in Manila Water marks a significant milestone in the company’s journey towards becoming a leading water utility provider. This strategic acquisition not only consolidates Razon’s control over Manila Water but also underscores his broader ambition to fortify his infrastructure portfolio. As Ayala Corp continues to streamline its investments, the proceeds from these divestments will further bolster its capital reserves, allowing it to focus on its core business areas.

The future looks promising for Manila Water under Razon’s stewardship. With planned infrastructure enhancements and a strategic vision aimed at optimizing operations and expanding reach, the company is well-positioned to meet the growing needs of its customers and contribute to the sustainable development of water resources in the Philippines and beyond.

Key Takeaways:

- Strategic Acquisition: Razon’s Trident Water acquires an additional 23.6% stake in Manila Water from Ayala Corp for 14.5 billion pesos ($252 million).

- Ayala Corp Strategy: The transaction is part of Ayala’s broader strategy to rationalize its portfolio and raise capital, totaling 51.5 billion pesos from divestments.

- Infrastructure Expansion: Razon’s investment aligns with his strategy to expand his infrastructure portfolio, including developing a dam project and deepwater wells.

- Future Prospects: Manila Water, under Razon’s leadership, is set to enhance its operational efficiency and expand both domestically and internationally, ensuring sustainable growth.

This comprehensive analysis of Enrique Razon’s deepened investment in Manila Water not only highlights the financial and strategic implications of the transaction but also underscores the broader impact on the water utility’s future operations and growth trajectory.